Data Source: Footprint GameFi Research

The crypto market sustained its early Spring revival in April, with the price of BTC reaching an 11-month high. The GameFi industry has also seen signs of life again, with an uptick in metrics like funding rounds and active users — but without any truly exciting swings.

While there were no gargantuan funding rounds like CCP Games’ in March, one of the most exciting new combat sports promotions, Karate Combat, received $18M to develop their Web3 vision. Interestingly, this will include the $KARATE token… Are ICOs back in style?

Data from this report was obtained from Footprint’s GameFi research page. An easy-to-use dashboard containing the most vital stats and metrics to understand the GameFi industry, updated in real-time, you can find all the latest about prices, projects, funding rounds, and more by clicking here.

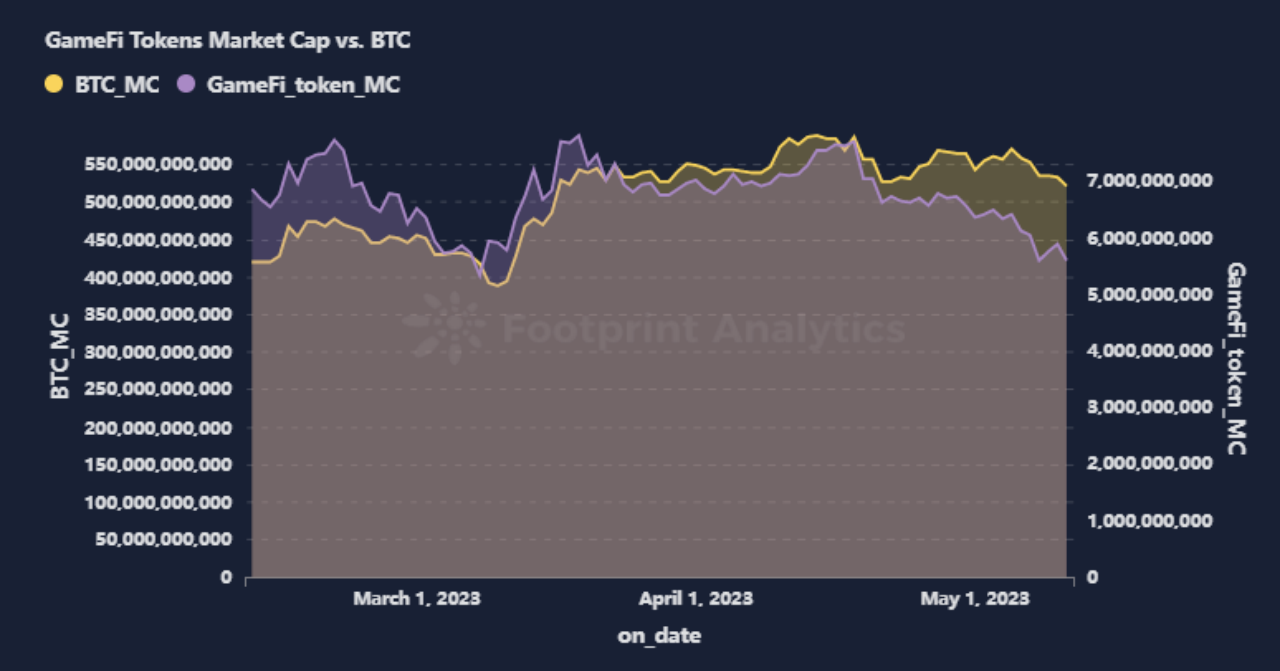

● The BTC price held above $27K resistance and reached an 11-month high of $30,506

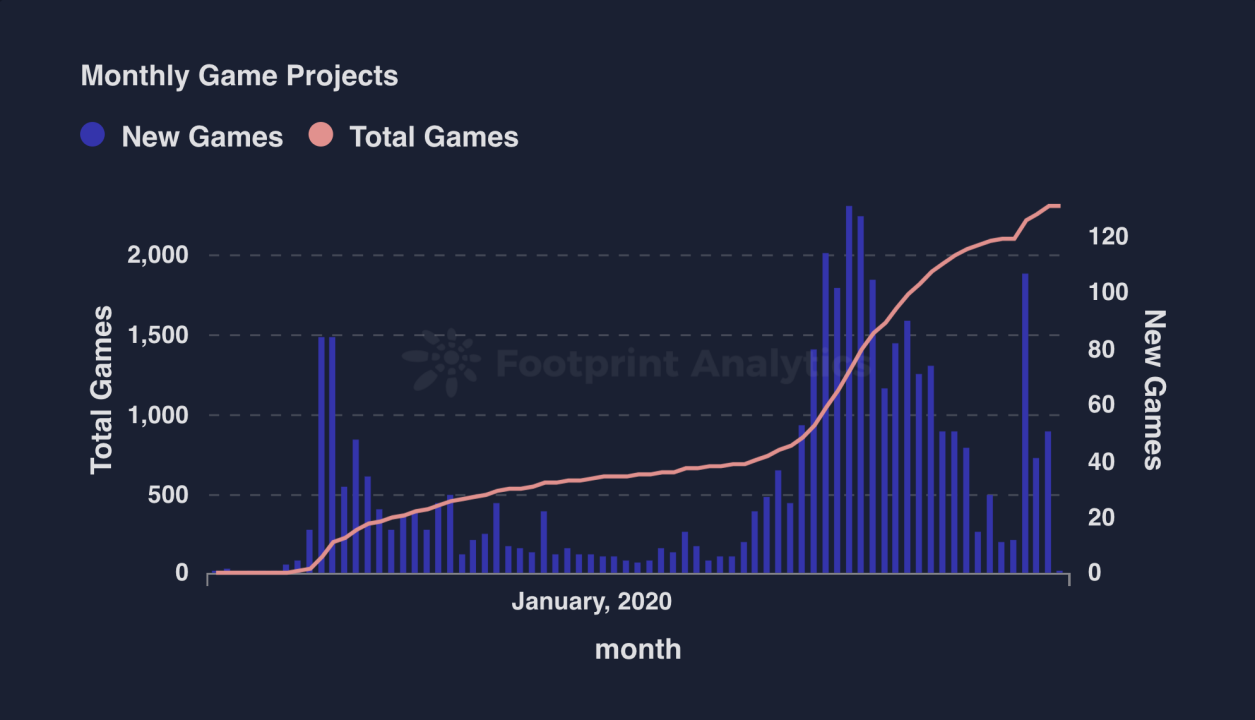

● 51 GameFi projects were launched

● There were a total of 1,040 active games by the end of April

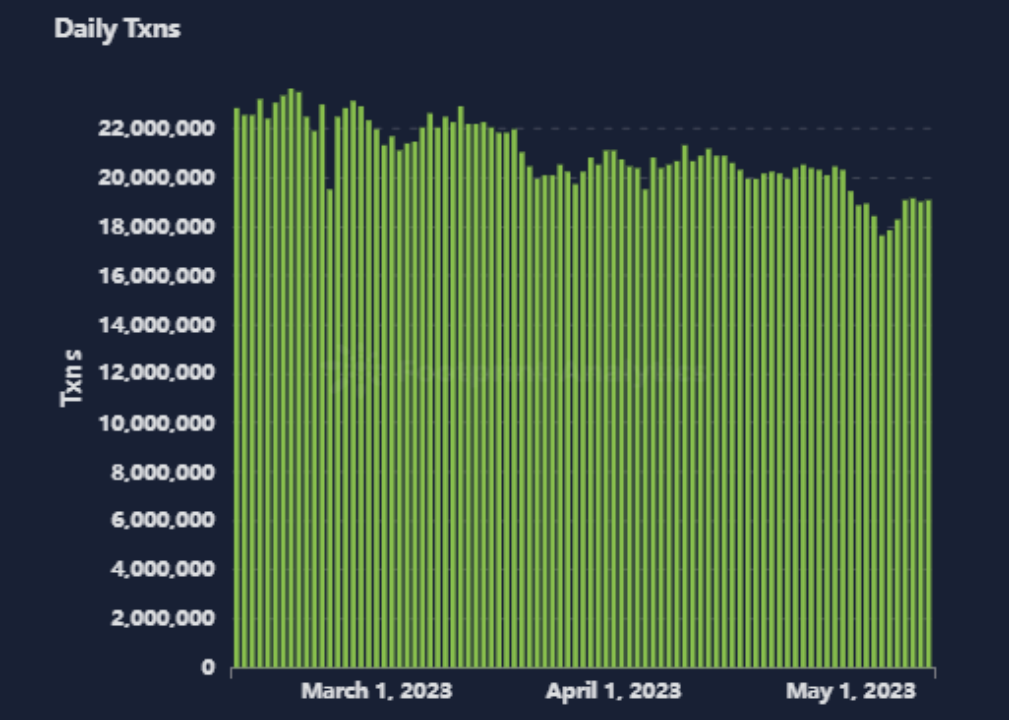

● Transactions decreased 8.2% MoM

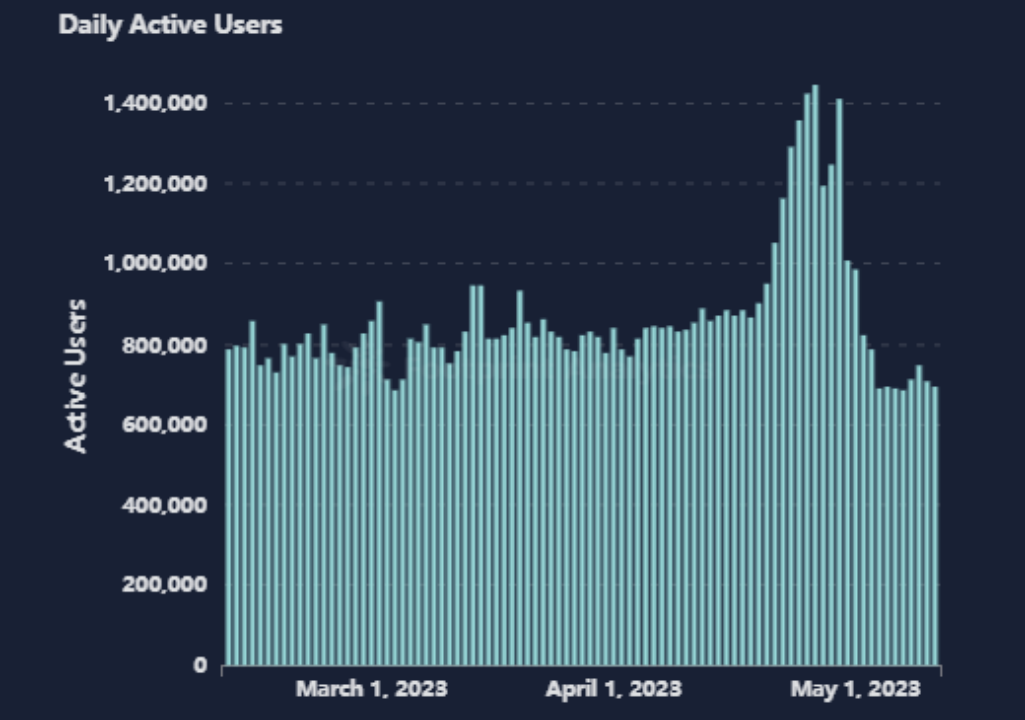

● In April, GameFi experienced a significant increase in user acquisition and retention. On April 26th, the number of users jumped to 1.49M, representing a growth rate of 72.4%.

● Wax, Polygon, BNB, and Ethereum had the largest number of active games in April, respectively

● BNB had 20 new GameFi projects launch

● BNB was the most collaboratively open ecosystem, with 54% of the share of volume

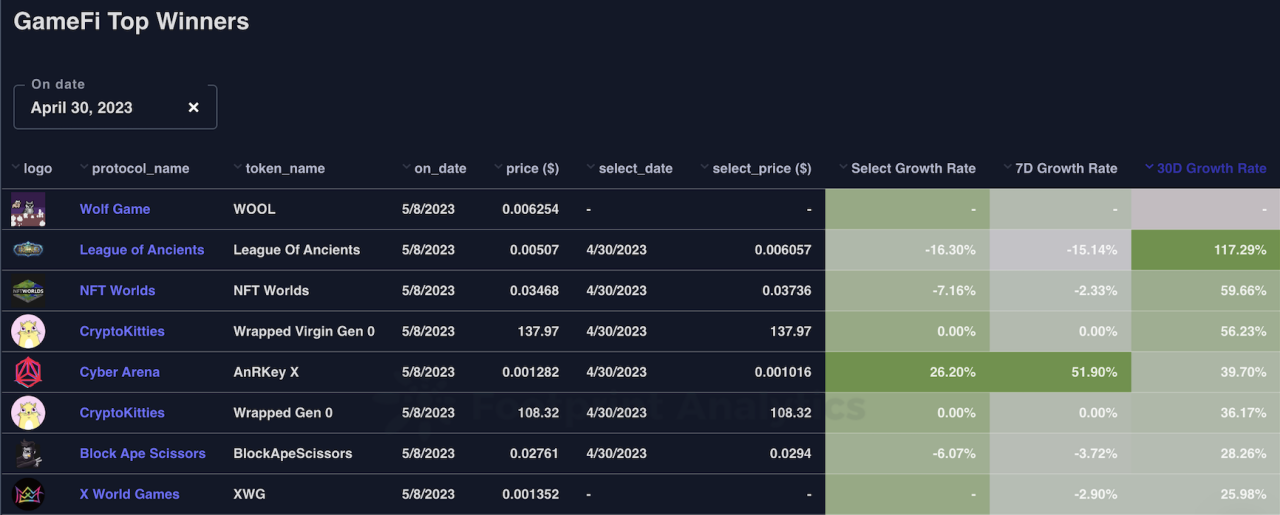

● The price of tokens for League of Ancients, NFT Worlds and Cryptokittes, increased by 117%, 59%, and 56% MoM — some of April’s major GameFi winners

● Crabada tokens lost more than 60% of their value in April

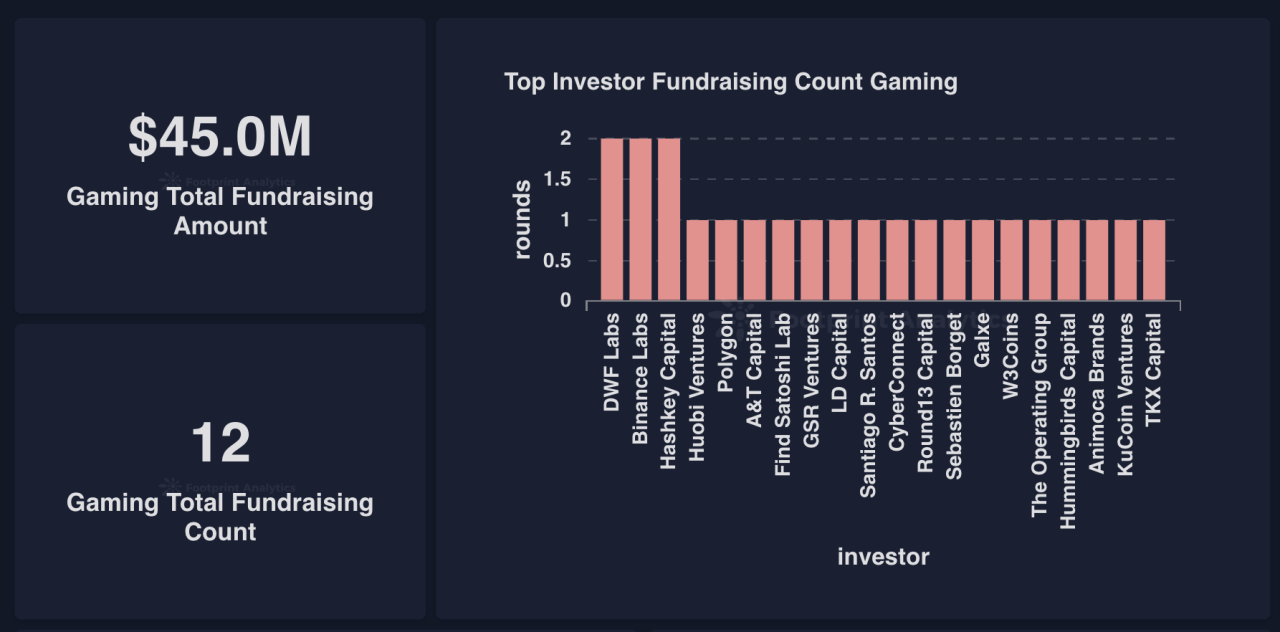

● The GameFi industry closed 12 rounds and $45M in fundraising

● Karate Combat closed the largest deal of $18M

● RACA closed the second-largest round, raising $16M

The BTC price held above $27K resistance and reached an 11-month high of $30,506

The market cap of GameFi tokens was tightly correlated with Bitcoin for most of April, but saw a sharper relative decline in the second half of the month (April 15 to May 1).

In the second half of the month, bitcoin’s market cap fell by 7.2%, while GameFi tokens saw a much larger drop of 15.5%. This disparity suggests that GameFi projects are inherently riskier and more susceptible to funding fluctuations during market downturns. As investors tend to withdraw from risky assets in times of economic uncertainty, GameFi tokens are particularly vulnerable. However, this downturn also presents potential investment opportunities for those willing to take on the additional risk.

While the GameFi market has experienced a significant decline, it serves as an important reminder for investors to maintain a balanced portfolio with diverse investment options and to be vigilant in managing potential risks.

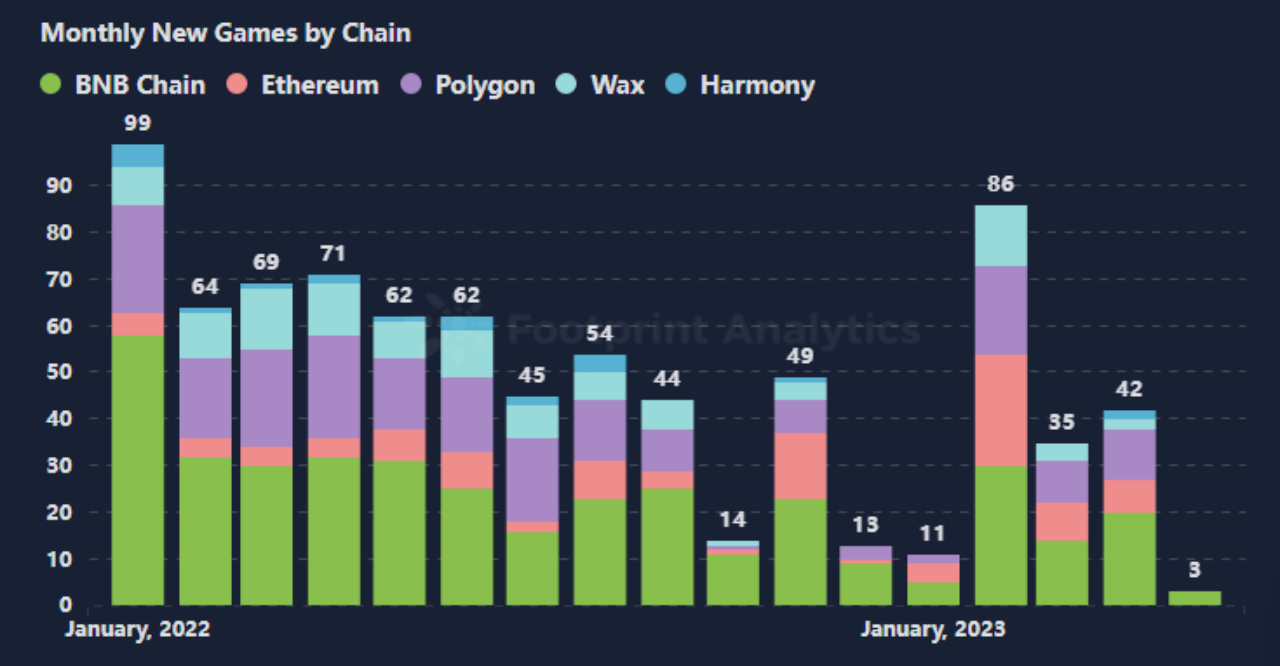

There were 51 new GameFi projects launched in April.

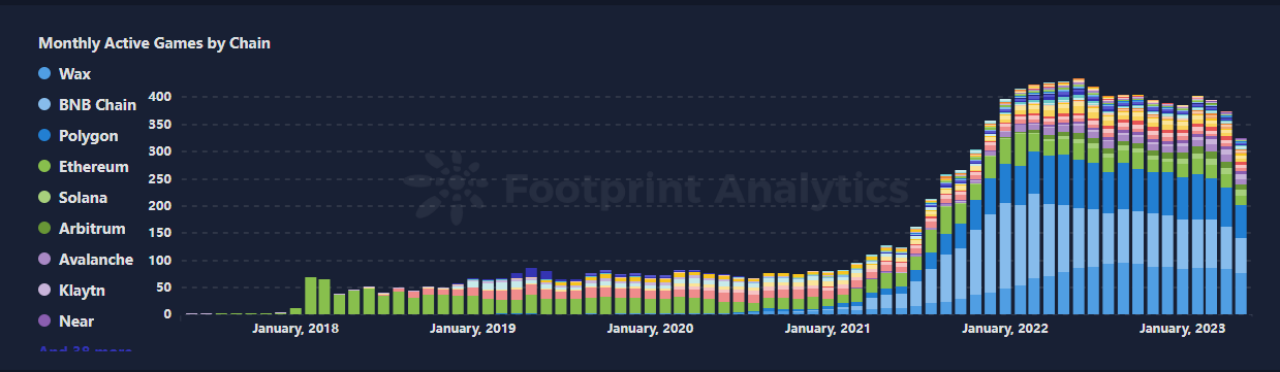

This is 10 more than in March but a considerable drop from February’s unusually high number of 107. The number of active games also reached an ATH of 1,040 in April.

Note that this metric has generally trended upwards, with some slight monthly dips.

Transactions declined from 21M to a monthly low of 19.3M on April 23.

Total MoM transactions declined by 8.2% from March.

Analysing the market data, we can see that the decline in market capitalisation has been observed for both bitcoin and GameFi tokens. However, the decline for GameFi tokens has been significantly higher than for bitcoin. This suggests that user activity has decreased, leading to a reduction in trading frequency among active users, possibly due to a reduction in user stickiness or fewer in-game trading opportunities.

While transaction data has declined in April, the situation is not too severe and the long-term fundamentals of the industry are not expected to be significantly affected.

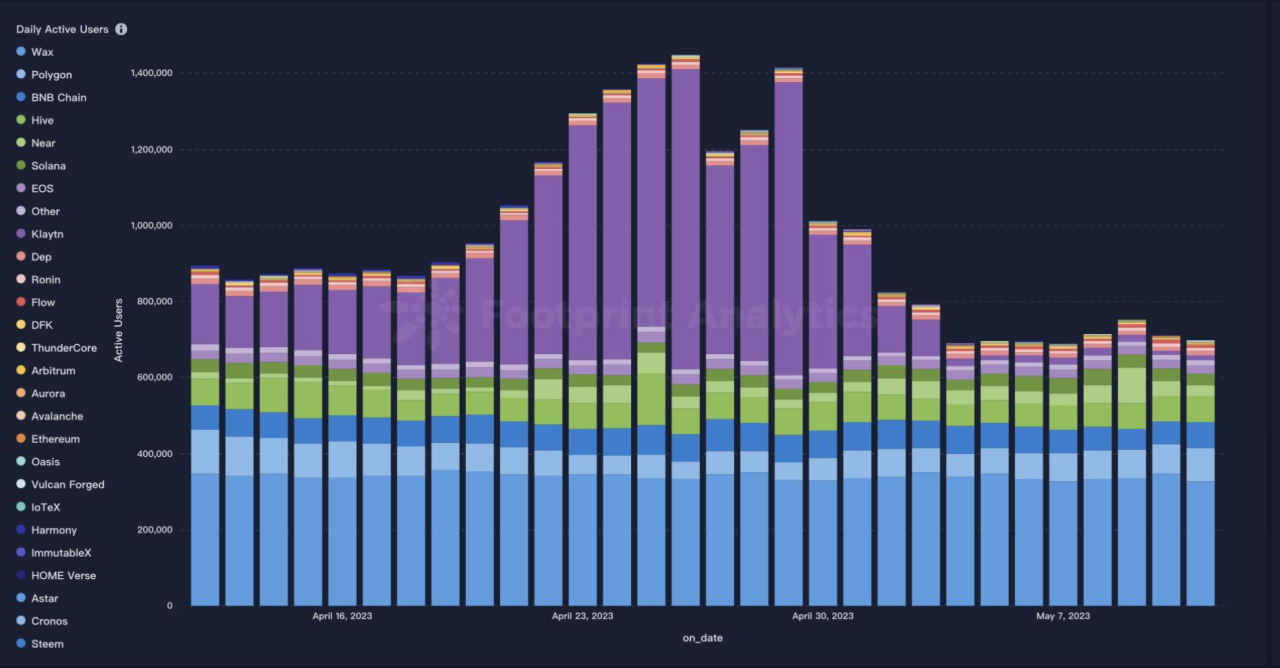

GameFi’s user data showed some fluctuations in April, but the growth trend remained upward.

In April, GameFi experienced a significant increase in user acquisition and retention. On April 26th, the number of users jumped to 1.49M, representing a growth rate of 72.4%.

While the number dropped to 1.01M on April 30th, it remained higher than the beginning and end of the month, indicating that the April 26th spike was not a one-time event and that new users were being retained to some degree. This is a positive signal for related projects in the GameFi ecosystem.

The breakdown of the most actively developed chains remained mostly the same.

Wax, BNB, Polygon, Ethereum and Solana had 84, 78, 73, 23, and 12 active games.

BNB has the most new games, with 20.

It has shown impressive performance in April and is actively expanding into the GameFi space, making it a potential leader in this area. Its strong openness, low gas fees and strong liquidity support make it an ideal choice for gaming projects.

While Polygon also did well and had the second-highest, with 11.

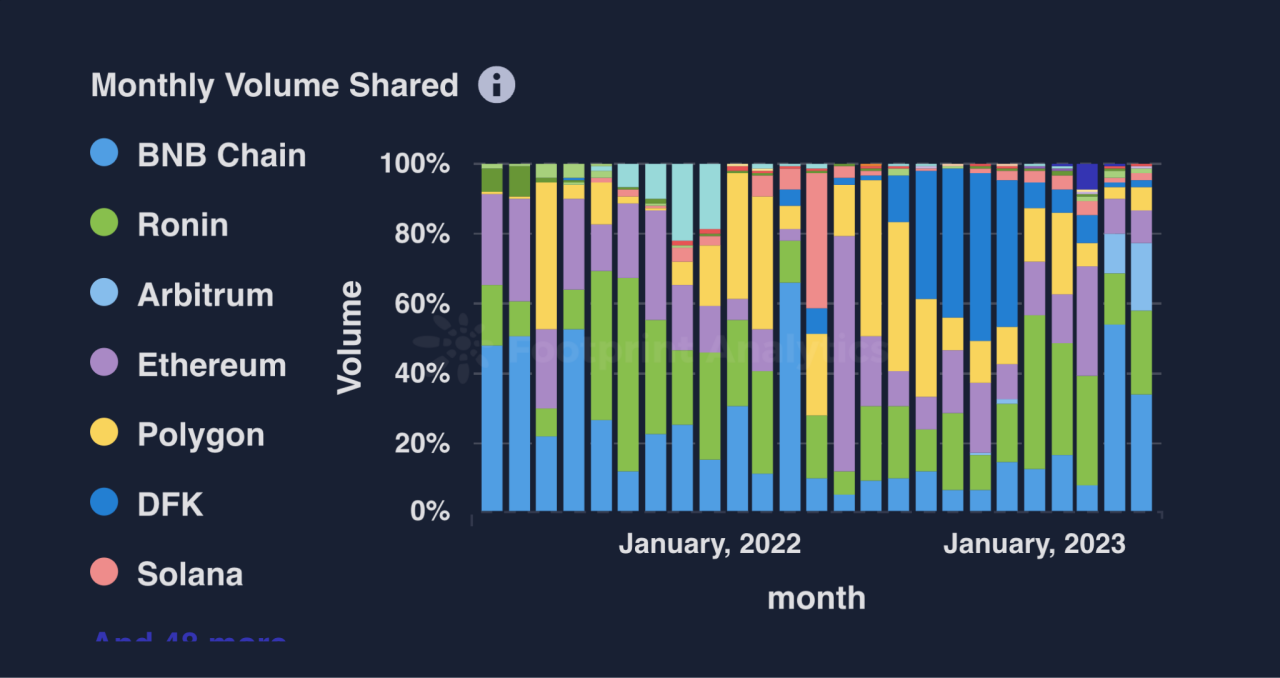

In April, 54% of the volume was for BNB projects.

On the other end of the spectrum, Solana had only 1.2% of volume

The best-performing projects by 30D price growth, excluding inactive games or very small ones, were League of Ancients, NFT Worlds and Cryptokittes.

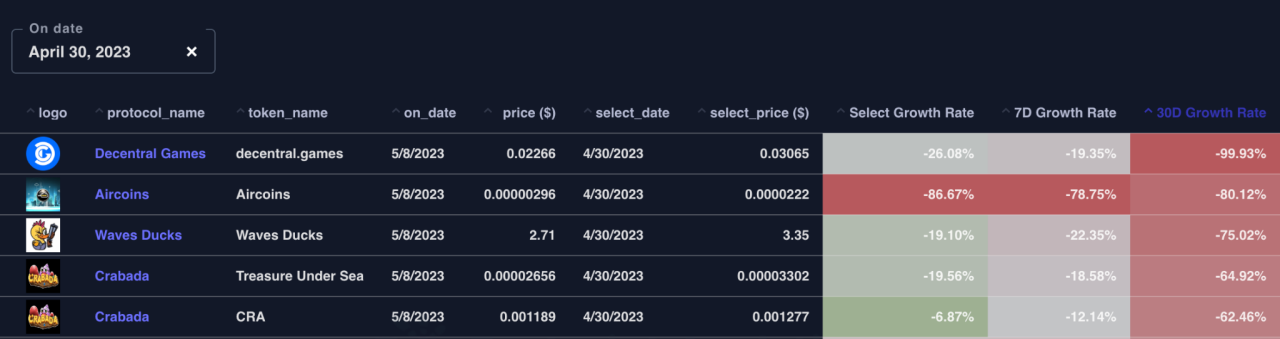

The once-promising Crabada was one of the biggest losers, losing well over 60% of both its tokens’ values.

The fall of the toke price indicates that the project may be in trouble or may not be meeting market expectations. The significant drop in the token price may also have a negative impact on the project, reducing community confidence and making it difficult for subsequent fundraising and development.

One year ago, the crab-themed fighting game was one of the largest and most active GameFi projects on Avalanche.

There was $45M in total GameFi funding spread across 12 rounds.

The number of rounds increased from the 5 in March, but the total purse failed to match the previous month’s $77M. (In March, Icelandic developer CCP Games closed a monster $40M round.)

Full-contact karate promotion Karate Combat closed the largest deal of April.

It raised $18M to build out its Web3 app and $KARATE token. Web3-native studio RACA also closed a large, $16M round.

This piece is contributed by the Footprint Analytics community.

We’re thrilled to invite institutions and projects to build out your own custom research pages like this. With our help, you can easily own your own data website for research without any coding experience or technical input. Simply fill in this form to apply for the waitlist and get started today.

ABGA

A non-profit, blockchain alliance, co-sponsored by leading institutions in the gaming industry. We are optimistic about blockchain games, NFTs and Metaverse, and we are taking the initiative to support ABGA-related activities and investments.

Footprint Analytics

Footprint Analytics is a data platform blending web2 and web3 data with abstractions. We help analysts, builders, and investors turn blockchain data into insights with accessible visualisation tools and a powerful multi-chain API across 20+ chains for NFTs, GameFi, and DeFi. We also provide Footprint Growth Analytics to help with effective growth in GameFi and any web3 projects.

©Asia Blockchain Gaming Alliance (ABGA) All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.