Description: Is the bear market the best time to watch the future of GameFi projects and assets?

Data Source: Footprint Analytics – June 2022 GameFi Report

While the GameFi market continued to bleed users while receiving much less funding in June, several popular games have kept their token prices and user numbers relatively stable. Additionally, game platform BinaryX reversed its downward trend, creating a rare bear market breakout, while game developer Playful Studios raised a record amount for its battle game Wildcard.

Despite how things look from the token price charts of former leaders like DeFi Kingdoms and Axie Infinity, these developments show that even though there is a lot of pain for devs and investors in GameFi, the industry is far from collapsing.

The overall market continues to be very negative. Footprint Analytics data indicates that last month:

GameFi marketplace volume declined 30.3% MoM, with a $166 million decrease in transaction volume.

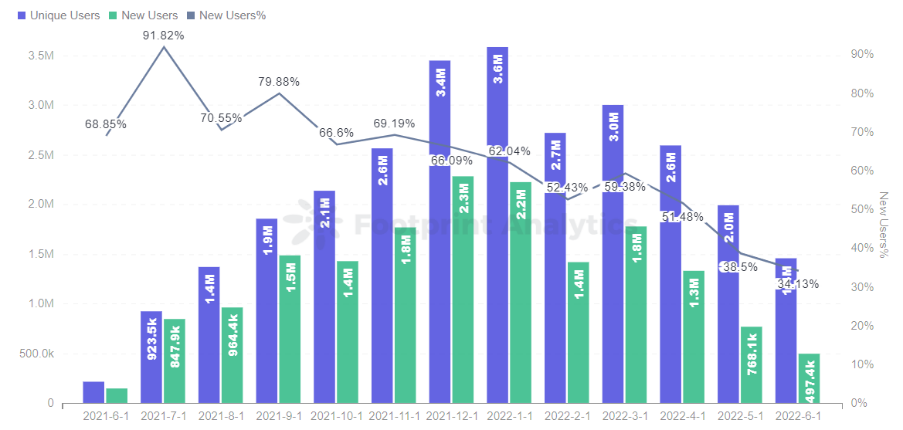

GameFi had 1.46 million total users, a 26.9% MoM decline. The number of new users also gradually decreased by 34.1%.

VC investment in the GameFi sector was down 57.7% MoM.

On the other hand, aside from the gloom, so-called “risky” investments like metaverse land and NFTs have performed relatively well compared to “safe” assets like BTC and ETH. We explored this topic via three hypothetical BTC/ETH, NFT, and metaverse land portfolios and found that the BTC/ETH (by some calculations) dropped harder from ATH than top NFT and metaverse projects. For the latter two “riskier” assets, returns are significantly higher in a bull market.

Here’s what happened in GameFi in June.

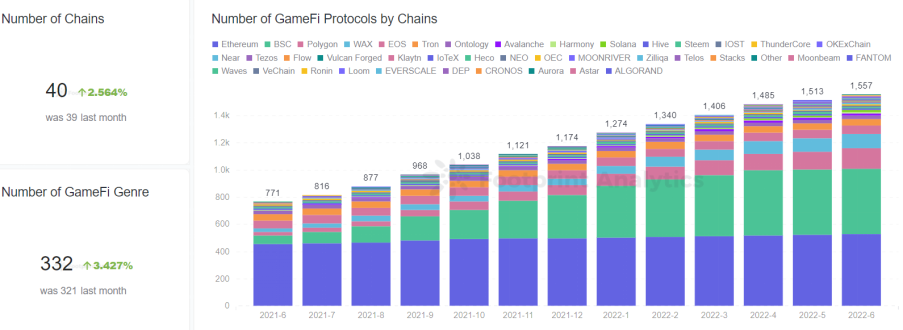

The number of GameFi games stood at 1,557, up 2.9% MoM. Newly released GameFi projects include MIND Games, Fishing Lands and Fantom Survivor. They currently have very few transactions and users.

Footprint Analytics – GameFi Protocols/Chain/GameFi Genre

Footprint Analytics – Newly Released GameFi Projects

Although the market is in extreme fear, it has not stopped new projects from emerging.

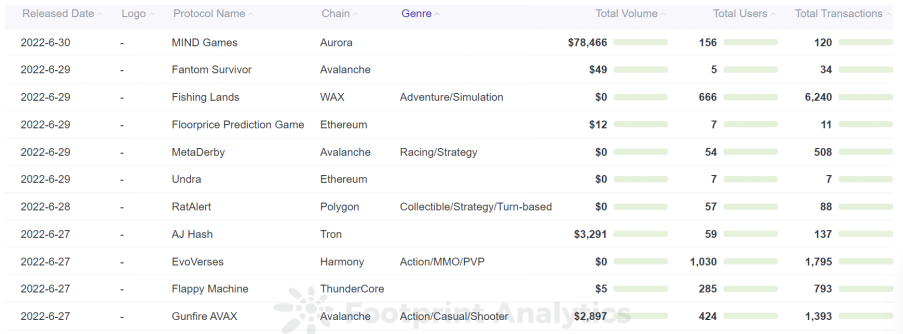

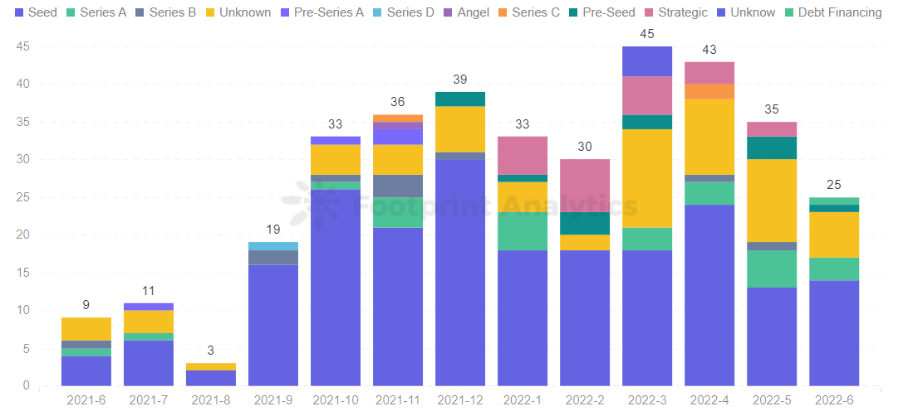

Financing was down by $239 million, or 57.7%, from May. In terms of the number of financing rounds, there were more seed rounds than any other type.

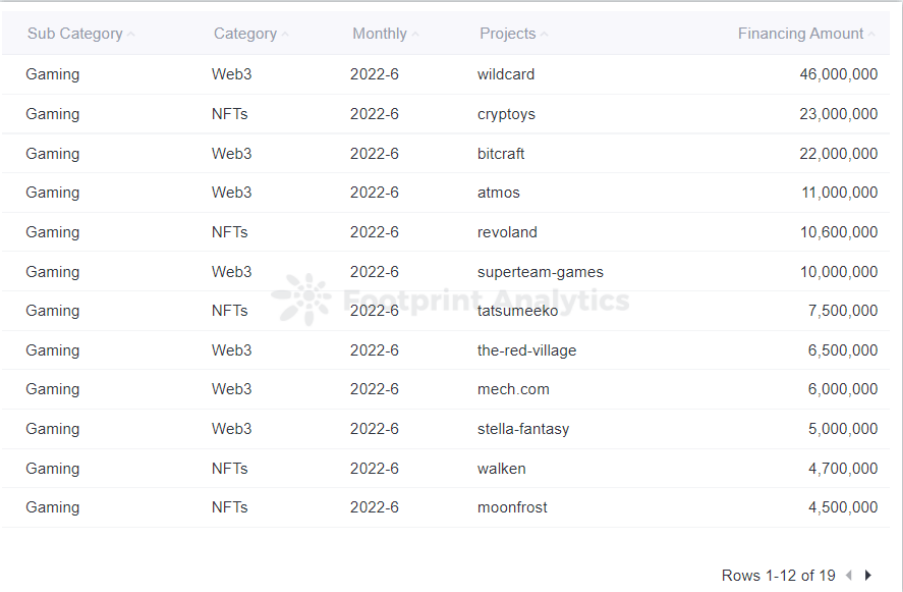

Capital mainly flowed to the Web3 and NFTs categories. One Web3 project, Wildcard, received $46 million, making it one of the few dark horses in the bear market. Cryptoys, a digital, collectible NFT toy project, closed a $23 million round led by a16z.

Footprint Analytics – Gaming Financing Distribution

Footprint Analytics – Number of GameFi Projects Funded in June

Despite more innovative games and projects beginning to emerge, the macroeconomic environment and volatility of the crypto market pushed the number of active users down from a peak of 3.58 million in January to 1.46 million by the end of June. The number of new users also gradually decreased to 500,000. Compared with May, the number of active users decreased by 26.9%, and the number of new users decreased by 16.1%.

Footprint Analytics – Monthly GameFi Users

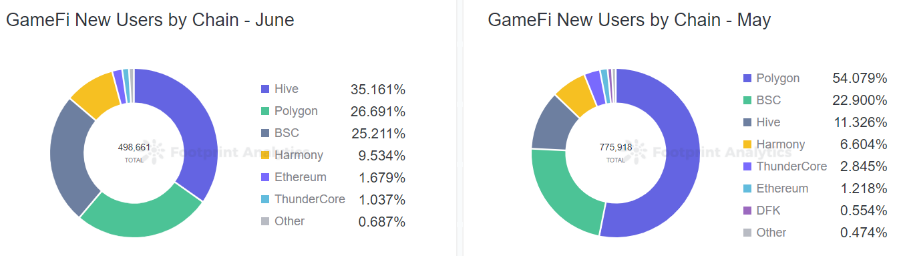

Footprint Analytics – GameFi Unique Users by Chain

Footprint Analytics – GameFi New Users by Chain

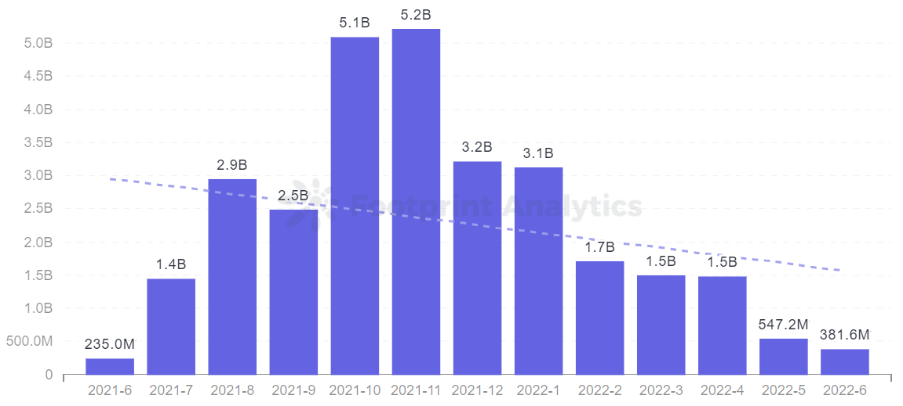

In addition, the overall transaction volume decreased in June compared to May, with a 30.3% decrease from the previous month.

Footprint Analytics – GameFi Monthly Volume

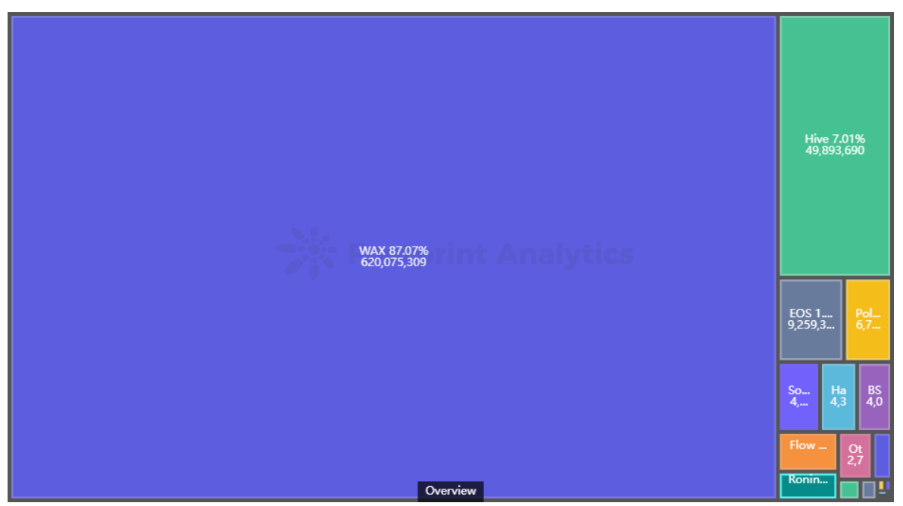

WAX has the most GameFi transactions out of all chains at 87% of the total. This is due to its top 2 game projects, Farmers World and Alien Worlds. Both have maintained a stable number of transactions and users during the bear market.

Footprint Analytics – June Gaming Txn by Chain

Footprint Analytics – Top 5 Games by Users

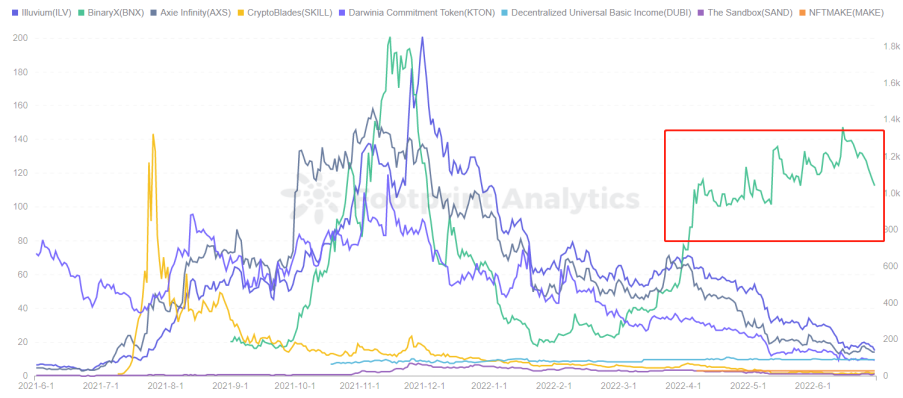

With the bear market in full swing, formerly lucrative projects like Bomb Crypto, DeFi Kingdoms and StepN have seen their NFTs and tokens devalued to a fraction of their ATHs. BinaryX, originally a trading protocol that transitioned to GameFi and launched a successful title called CyberDragon, looked to be one such project among many.

BinaryX issued its governance token, BNX, at $20.62 in September. In November, Binance announced that BNX was on the Innovation Board and could be deposited on the platform as a demand money currency, which means that the currency has no pledge period. Holders can directly purchase for any number of days to obtain income, with an APR of 15%, which led BNX to hit an all-time high of $200.71 on November 15, an increase of 873%.

Footprint Analytics – Top 10 GameFi Token Price

But the good times didn’t last long. Because the developers of BNX CyberDragon were eager to cash out at the time, they modified the character upgrade function of the game several times. According to different levels of upgrades, a certain amount of Gold (sub-token produced by mining in the game) needs to be paid. For example: upgrading from level 1 to level 2 requires 20,000 Gold.

As a result, most players sold their game assets and left the market, resulting in rapidly declining revenue. Except for some retained old players to continue playing, it isn’t easy to attract new users to enter the market, which affected the price of BNX from its all-time high of $200.71 on November 15 to an all-time low of $17.71, a drop of more than 90%.

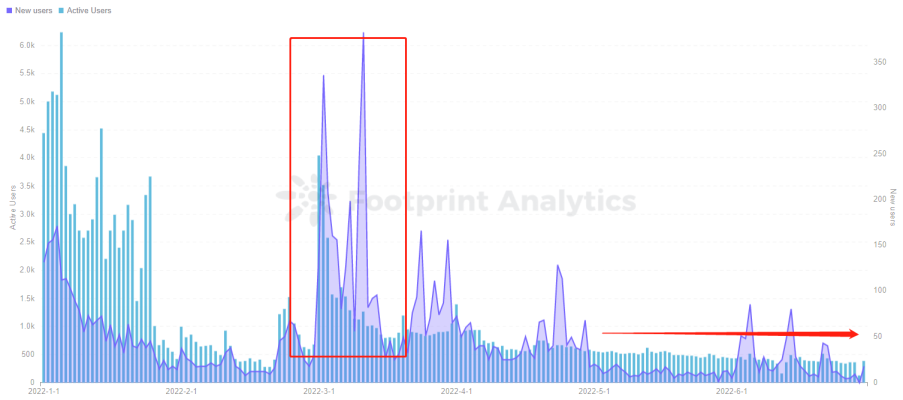

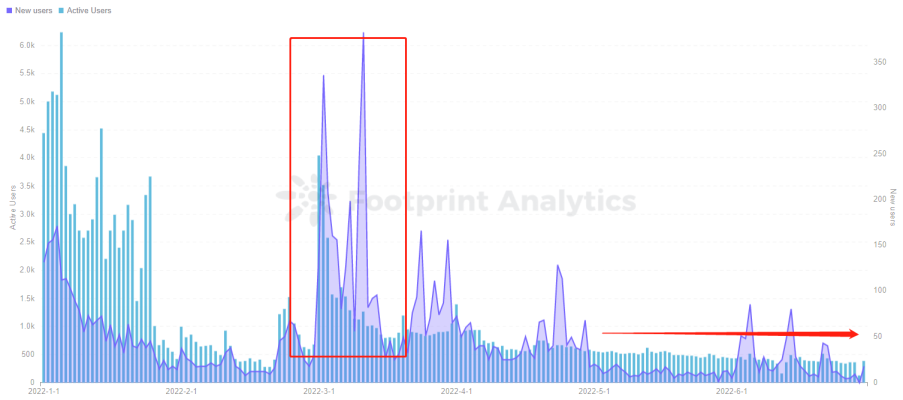

Footprint Analytics – BinaryX Daily New Users & Active Users

To save the project, BinaryX released version 2.0 – CyberDragon V2.0 in March and pulled back the data after the official AMA in May. Based on 1.0, 2.0 adds new gameplay and modes, which will be upgraded to a card-based self-operated strategy game. All dynamic economic models rely on self-regulated economic models.

Players spend 1 BNX and 50 BUSD (stable currency anchored with the US dollar) to extract heroes. Heroes have a mining cycle of about 90 days. Gold can be mined to obtain income. To upgrade heroes, NFT and Gold without mining functions are required to be charged. All BUSD will be used to repurchase and destroy BNX, which will also ensure that the price of BNX is in a relatively stable trend to a certain extent.

Footprint Analytics – Top 20 Gaming Financing Ranking in June

On June 14, Web3 Games subsidiary The Wildcard Alliance announced closing a $46 million Series A round of funding, which got everyone’s attention amid all the negative news.

The funding was for Wildcard, a hybrid multiplayer online battle game. Besides pitting their NFTs against one another, participants can interact and trade directly with in-game fans and holders.

In the current market environment of a massive devaluation of virtual assets, Wildcard was still able to get huge financing to support the development of its project.

While the overall market continued to slide with the crypto market in June, individual developments in the GameFi sector have shown that it might be more resilient than many belief.

June Events Review

NFT & GameFi

Stepn Returns to Crypto Market Top with 75% Price Spike in Last 7 Days

Yuga Labs breaks silence, X2Y2 outpaces OpenSea

NBA Top Shot leads with a 901.95% spike in sales volume

Paris Saint-Germain and Jay Chou launch an exclusive series of 10,000 “Tiger Champs” NFTS

Phantom and Magic Eden Partner to Deliver Integrated User Experience for Solana NFT Collectors

Metaverse & Web3

Metaverse Land Prices Boom By 879% Since 2019

Bertelsmann raises $500 mn for India, eyes early-stage investments in Web3

Layer Three Ventures Announces $30M Web3 Crypto Fund and Accelerator

A “very ambitious” $100M Metaverse R&D hub is being built in Melbourne

Facebook Pay rebrands to Meta Pay as Zuckerberg details a plan to create a digital wallet for the metaverse

DeFi & Tokens

Lido to Move to a Two-Phase Voting Governance Model with a Conventional Voting Phase and an Objection Phase

Following BTC’s Price Drop, Bitcoin Miners Benefit From a 2.35% Difficulty Reduction

Addresses starting with 0x40 paid about 13.4 million stablecoins to repay debts on Aave

TVL on Layer 2 fell to $3.78 billion, down 20.77% in 7 days

The largest BTC whale bought 927 BTC this month

Network & Infrastructure

Arbitrum Pauses Odyssey as Layer 2 Fees Surpass Ethereum Mainnet Fees

Axie Infinity Restarts Ronin Bridge Months After $625M Exploit

Ethereum Energy Consumption Sees Sharp Decline As Mining Profitability Drops

Cross-chain bridge Horizon attackers transferred 6012 ETH to Tornado Cash in batches

Tether to undertake full audit by top 12 firms for transparency over USDT reserves

Institutions

Genesis Faces’ Hundreds of Millions’ in Losses as 3AC Exposure Swamps Crypto Lenders

Global Alliance of Tech Founders Entrepreneur First Raises $158 Million in Series C Funding

Crypto Exchange Unizen Receives $200M “Capital Commitment” From Investment Group GEM

Crypto.com App Now Accepting Apple Pay

Coinbase Adds Support for On-Chain Polygon and Solana Transactions

Worldwide

Taiwan central bank governor considers interest-free CBDC design to prevent fiat deposit flight

North Korea Retains Lead In Crypto Crimes, Over $1.5B Stolen

Russian parliament approves tax break for issuers of digital assets

Central African Republic president launches crypto initiative following Bitcoin adoption

New York Crypto Moratorium Comes to a Standstill

Asia Blockchain Gaming Alliance( ABGA )——A non-profit, blockchain alliance, co-sponsored by leading institutions in the gaming industry. We are optimistic about blockchain games, NFTs and Metaverse and we are taking the initiative to support ABGA related activities and investments.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

©Asia Blockchain Gaming Alliance (ABGA) All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.