Description: Despite news of poor data performance and a plunge in cryptocurrencies, GameFi didn’t stop from growing slightly.

Jun. 2022, Vincy

Data Source: Footprint Analytics – May 2022 Report Dashboard

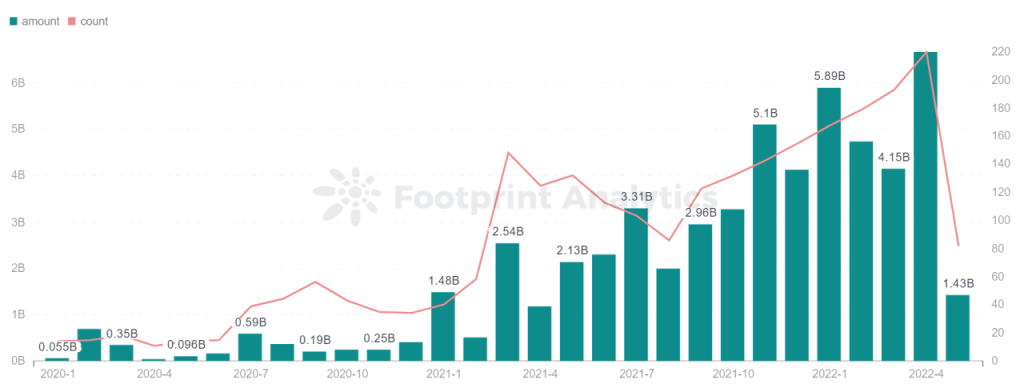

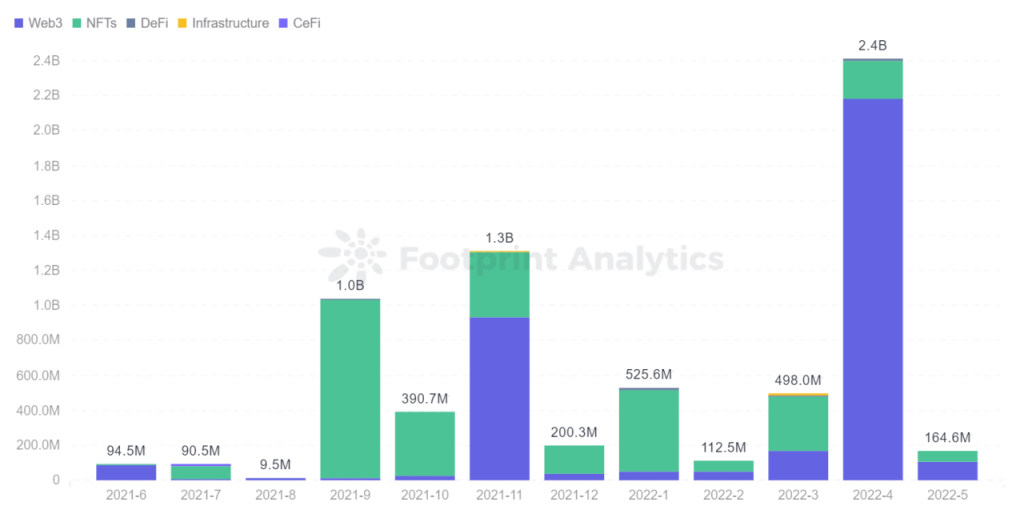

There were many ups and downs in May for the GameFi sector and cryptocurrency investors. Especially in terms of GameFi financing funds, it fell from a peak of $2.4 billion to $165 million, a drop of 93.14%. It is the most significant drop since 2021, which is lower than everyone’s expectations for the GameFi market.

The former leader, Axie Infinity, also took a hit. The number of players dropped from over 100,000 to less than 10,000.

Is there a risk of collapse? And StepN, which broke out during the bear market in May, crashed quickly. Can it see a reversal and continue leading M2E in the GameFi sector?

The following is the overall GameFi market in May and the changes in each project through data analysis.

After BTC, ETH, LUNA, and StepN tanked, there seems to be a consensus that a bear market is here.

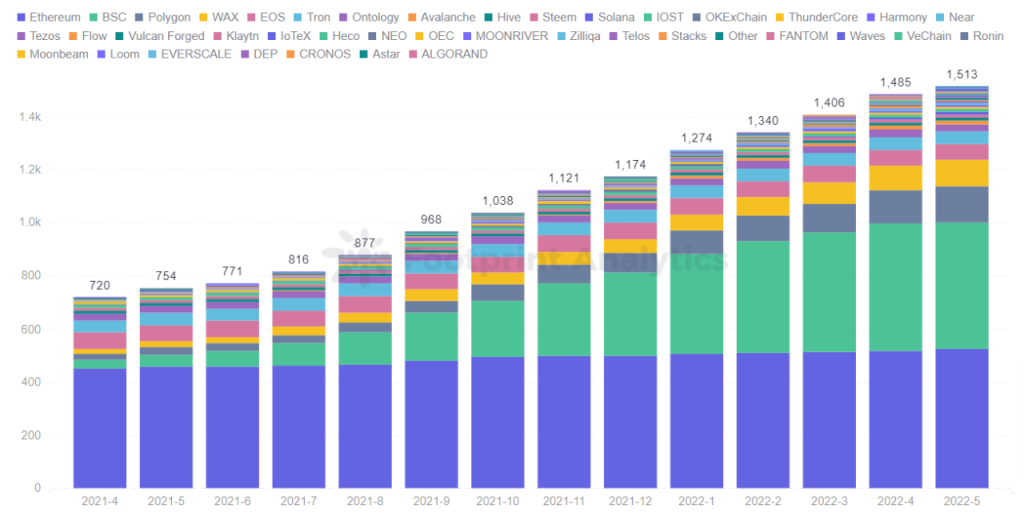

Regarding the number of GameFi projects, there was only a 1.9% increase in May, mainly due to the growth of projects on the Polygon chain. The development of the two main chain projects, Ethereum and BSC, has gradually slowed.

Footprint Analytics – Number of GameFi Protocols by Chains

Ethereum’s high gas fees and network congestion persist, which are significant factors in its failure to rapidly grow the number of projects. After notable game projects like StarSharks and Cryptomines failed to retain users, BSC also saw some problems.

On the flip side, Polygon is the blockchain with the most growth in the number of projects this month.

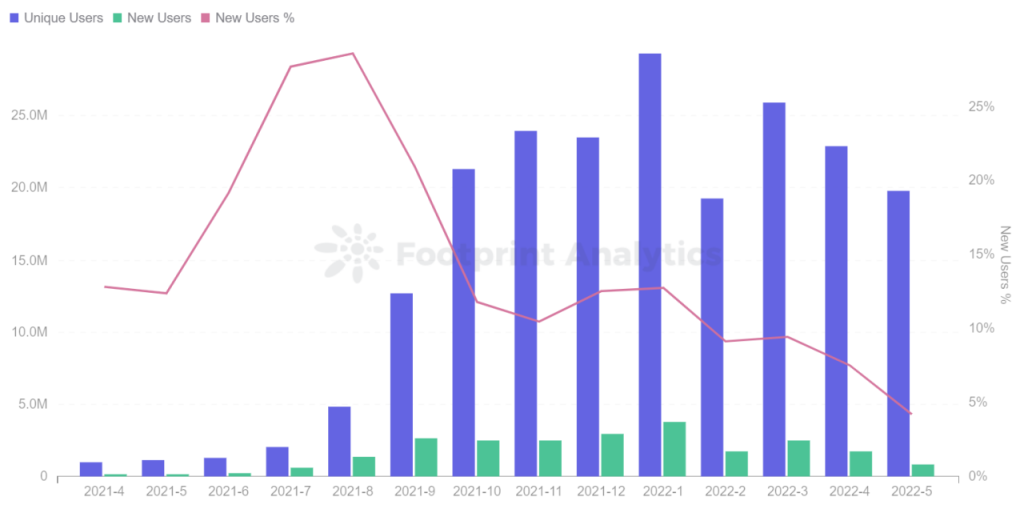

As of May 31, the total number of active users was 19.83 million, including 830,000 new and 19 million old users. Real active users fell 13.4% compared to April.

Footprint Analytics – Monthly Gamers Trend

Footprint Analytics – Monthly Gamers Trend

It is mainly affected by the number of users of some game projects on the BSC chain. Both old and new users dropped by 5% to 10%. For example, StarSharks was favored by many industry insiders before April, but it encountered a “death spiral” in just over a month, and the number of users dropped from 10,000 to 100.

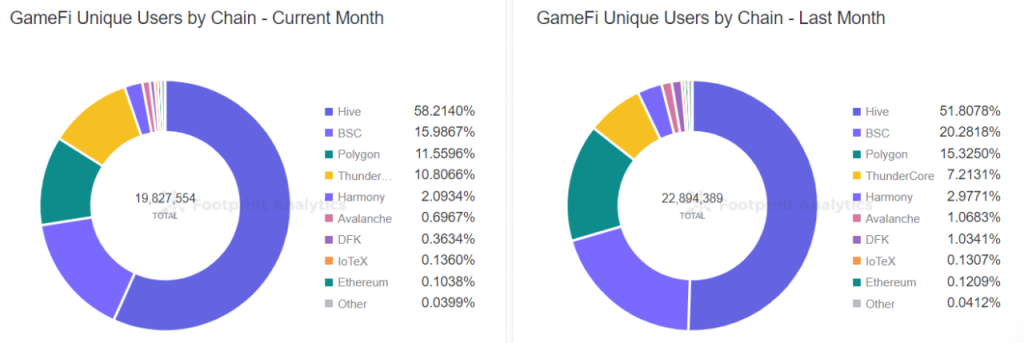

Footprint Analytics – GameFi Unique Users by Chain

Footprint Analytics – GameFi Unique Users by Chain

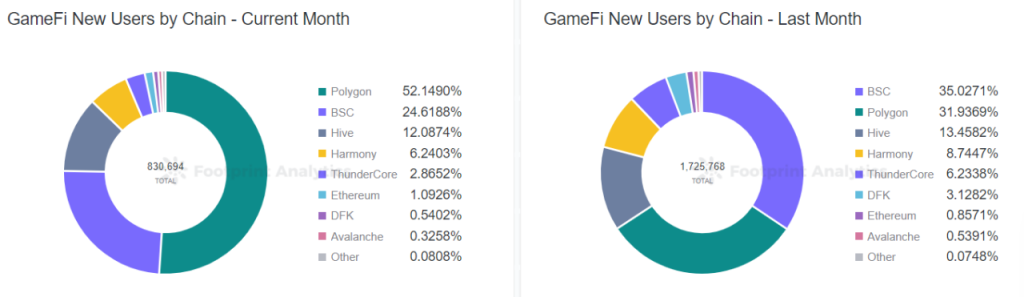

Footprint Analytics – GameFi New Users by Chain

Footprint Analytics – GameFi New Users by Chain

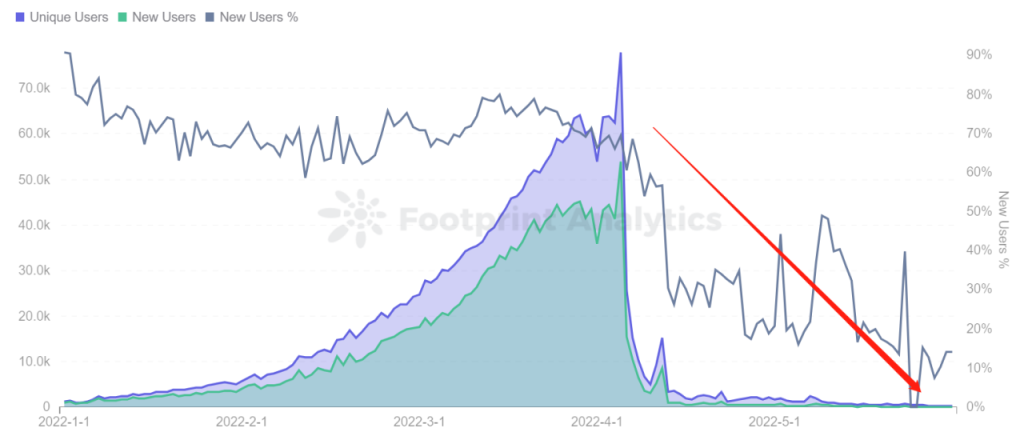

Footprint Analytics – StarSharks User Trend

Footprint Analytics – StarSharks User Trend

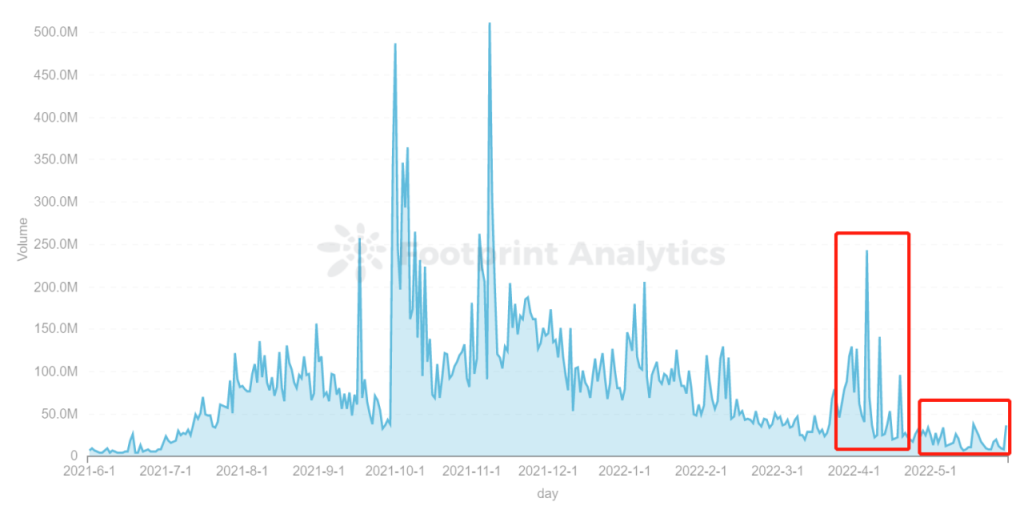

According to Footprint Analytics data, the overall daily trading volume in May decreased compared to April. Including top GameFi projects, Axie Infinity’s average transaction value fell from $26.85 million in April to $7.14 million. Splinterlands’ average transaction value fell from April $4,118 to $2,724. CryptoMines’s transaction volume almost halved.

Footprint Analytics – GameFi of Volume Trend

Footprint Analytics – GameFi of Volume Trend

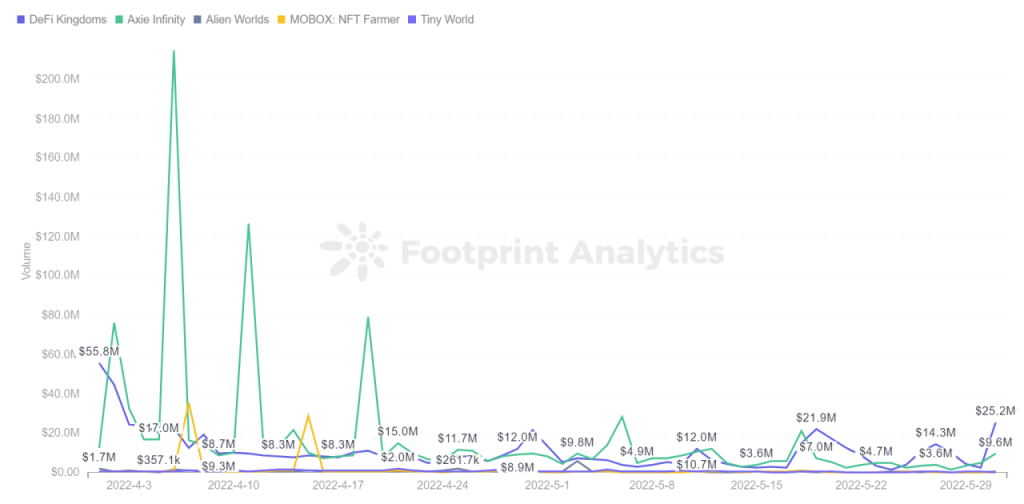

Footprint Analytics -Top 5 Games Trading Volume Trend

Footprint Analytics -Top 5 Games Trading Volume Trend

Investments across the blockchain sector totaled $1.43 billion in May. The GameFi sector accounted for 11.5% of the total investment, with $165 million. Compared to April, the GameFi investment amount declined by 93.14%.

Footprint Analytics – Funding-Monthly Investment Trend

Footprint Analytics – Funding-Monthly Investment Trend

Web3 has seen the most significant drop in GameFi investment, but that doesn’t mean Web3 has lost its dominant position. According to news, on May 18, a16z launched a $600 million fund dedicated to gaming startups to increase bets on Web3 technology. So Web3 remains an essential sector of institutional focus, and it will be one of the core technologies of GameFi.

Footprint Analytics – Gaming Financing Distribution

Footprint Analytics – Gaming Financing Distribution

The crypto market is experiencing a severe downturn, with the prices of most cryptocurrencies and algorithmic stablecoins falling to their lowest levels.

After Axie Infinity was attacked, it continued to show a downward trend, and the sharp decline in its SLP and AXS was severe.

According to Footprint Analytics data, Axie Infinity’s token SLP fell to $0.0057 as of May 31, down 98.5% from its previous all-time high of $0.37. The governance token AXS also fell to $23.79, down 84.9% from its last all-time high of $157.80.

Footprint Analytics – SLP Price & AXS Price

Footprint Analytics – SLP Price & AXS Price

Axie Infinity’s economic activity relies heavily on the battle and breeding functions, earning SLP and AXS through pet battles and consuming SLP and AXS through pet breeding. Therefore, these two tokens are critical to the game. Once they go to zero, Axies become worthless.

To avoid falling into a death spiral due to the price of tokens, the Axie team has removed SLP mining from single-player adventure mode. It is launching the Origin Android version on May 12 and announcing that it will allow the use of buying Axie and other assets in Axie Infinity Market with any cryptocurrency. However, these measures did not stop its price from falling.

It’s too early to say whether Axie Infinity will collapse.

Another fast-rising game, StarSharks, also faced a drop in coin prices. SSS fell from a peak of $14.91 to $2.26.

Footprint Analytics – Token SSS Price

Footprint Analytics – Token SSS Price

To sum up, for many P2E GameFi projects, the early stage is as simple as allowing players to earn profits and the importance of maintaining long-term value gains for players. It is necessary to continuously introduce new players to invest further funds in the game, optimize tokenomics, and give higher security to reduce the possibility of the project falling into an economic recession.

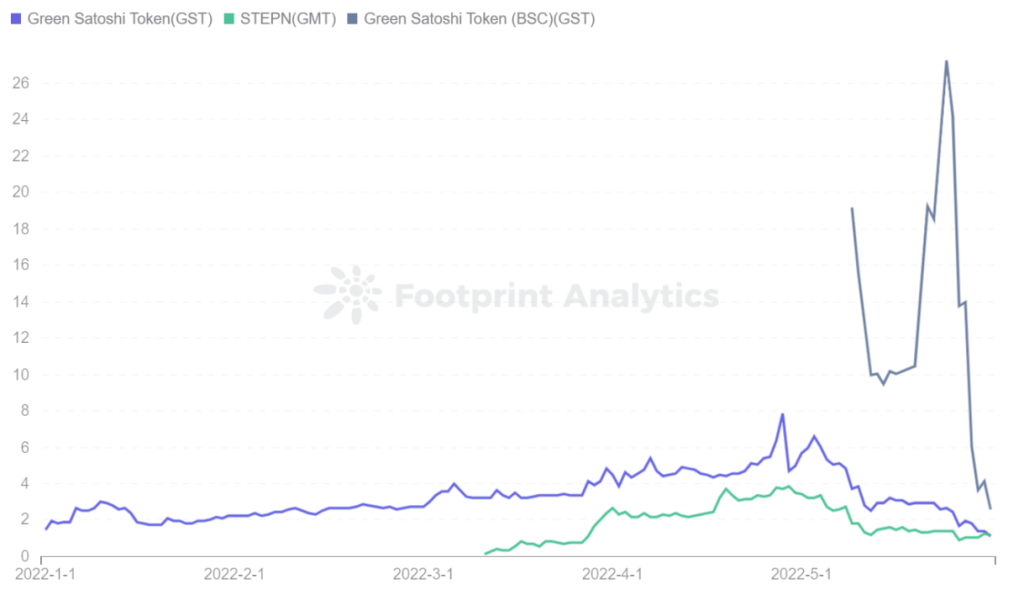

StepN is solely responsible for the rapid rise of Move-to-Earn and has launched on Solana and BSC. It’s one of the first successful mobile blockchain games.

On May 25, StepN’s GMT and GST coin prices continued to fall. The GST coin price on the BSC chain declined from $27.26 to $2.58, a drop of 90.53% in just seven days, due to the selling pressure on SOL, GST, and GMT and the official announcement of a block of mainland Chinese users. Token GMT coin prices dropped slightly.

Footprint Analytics – StepN Token Price

Footprint Analytics – StepN Token Price

Despite the continued slide for many leading GameFi projects, new funding rounds persist.

Current events will clarify whether a death spiral means the death of projects or could be seen as a stress test, allowing the project to recover even stronger.

May Events Review

NFT & GameFi

NFT minted on Cardano exceeds 5 million

Google Trend Data for ‘NFT’ Shows Global Interest Slashed by 70%

X2Y2 launched an automatic reinvestment tool, which can automatically purchase the WETH income obtained by users as X2Y2 tokens for re-pledge

NFT market enthusiasm declined, and gas fees fell to the lowest level since June

STEPN removes GPS in China amid regulatory concerns

Metaverse & Web3

Web3 gaming platform Village Studio completes 鈧2.1 million pre-seed financings, led by Animoca Brands

Metaverse Real Estate Sells for a Record $5 Million Inside TCG World

Footprint Analytics Grows Funding to $4.15 Million in Seed Plus Round

Brave Browser now Integrates with Solana Blockchain to Expand Web3 Access

Metaverse app BUD completes $36.8 million Series B financing, led by Sequoia Capital India

DeFi & Tokens

DAI Takes the Reigns as the Leading Decentralized Stablecoin by Market Capitalization

An Anchor protocol breach led to a loss of $800,000 following the launch of the Terra chain

ETH profitability hits a 22-month low of 57.31%

The concentration area of lending and clearing on the Ethereum chain is $1459 and $1193

Bitcoin dominance increases to 45%, the highest level since October 2021

Network & Infrastructure

Ethereum L2 has been down 40% since early April

Ethereum has more than 81 million non-zero addresses, a record high

Terra gets a second life as a new blockchain goes live with LUNA 2.0 airdrop

LUNA founder Do Kwon faces accusations of fraud over Mirror Protocol

Avalanche loses $60M in the UST crash

Institutions

Crypto Giant FTX Ready With Billions of Dollars for Acquisitions

Singapore crypto-focused VC raises $100m for the third fund

Google seeks fresh talent to lead the global Web3 team

Crypto exchange Gemini plans to suspend UST and MIR trading

Brazilian crypto exchange Nox Bitcoin compensates UST users with USDT 1:1

Worldwide

South Korean authorities reportedly probe staff behind Terra

Ukrainian Eurovision Winner Sells NFTs in Support of Ukraine’s Defense

Korean financial authorities Plan to Develop Regulatory Regulations Related to StableCoins and DeFi

New Zealand Authorities Investigate Crypto Ponzi Scheme

U.S. lawmakers have introduced more than 80 crypto bills this year, a record number

The Footprint Analytics community contributes to this piece.

The Footprint Community is where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. You’ll find active, diverse voices supporting each other and driving the community forward.

========================